January 19, 2025

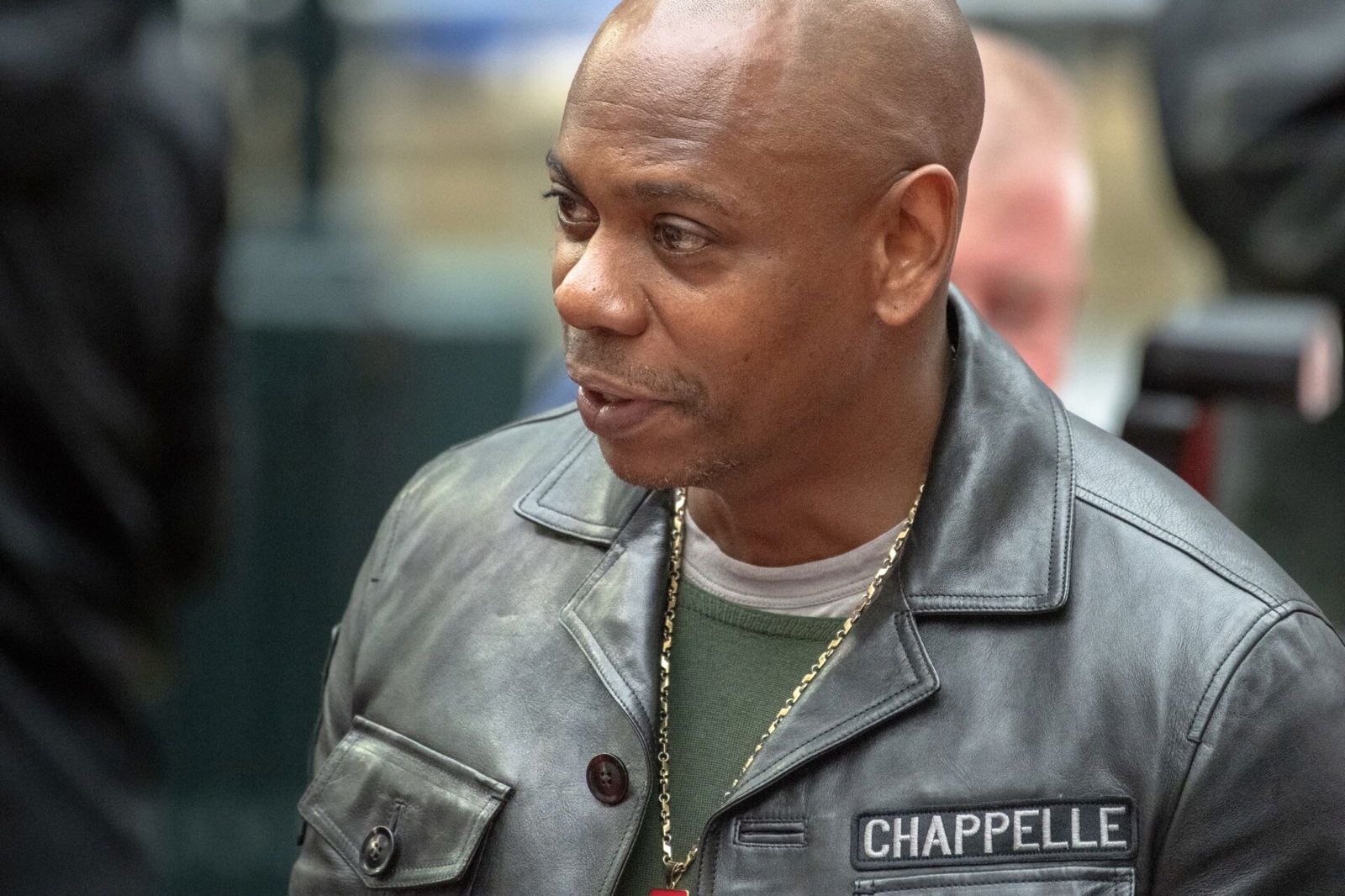

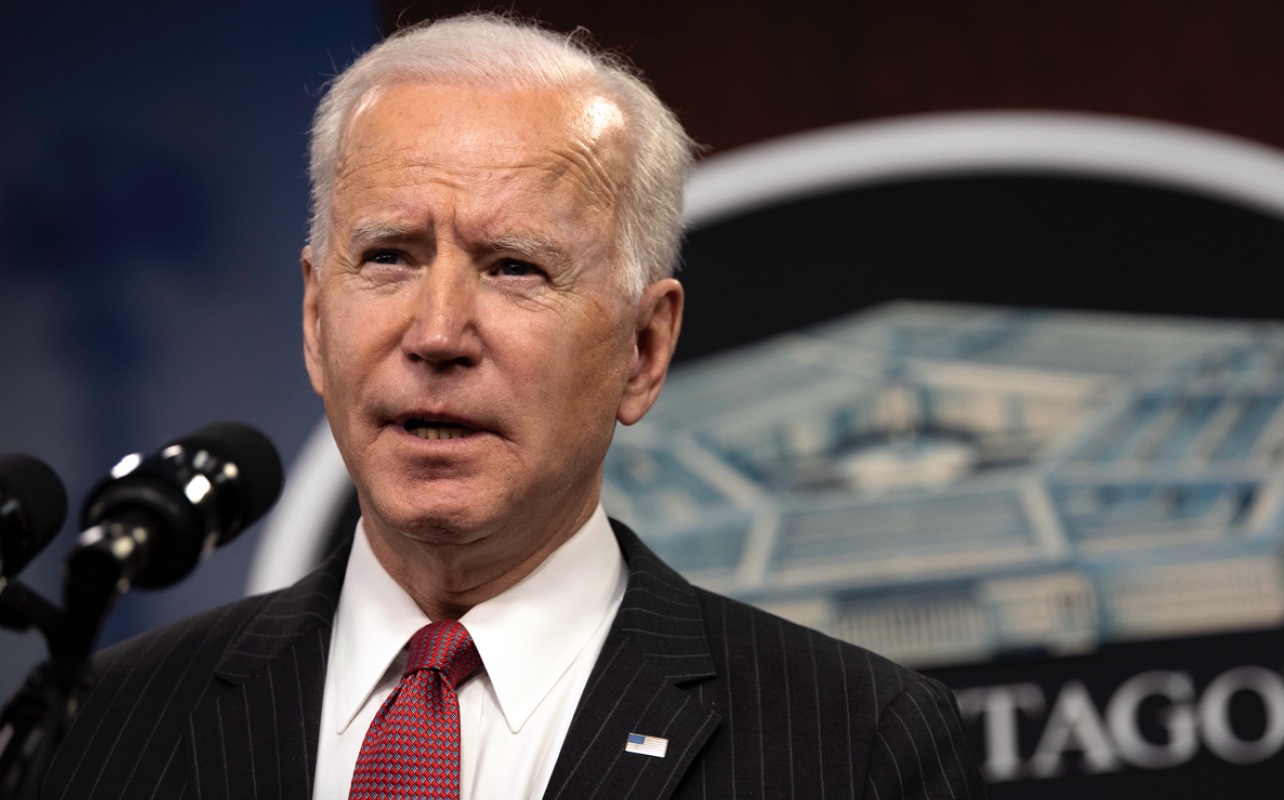

President Biden Visits Charleston’s Royal Missionary Baptist Church On Final Trip

Biden delivered his remarks at the service at Royal Missionary Baptist Church in observance of Martin Luther King Jr. Day.

On Jan. 19, President Joe Biden attended services at the Royal Missionary Baptist Church in Charleston, South Carolina, as part of his last presidential trip before ceding the office to President-elect Donald Trump on Jan. 20.

According to The Hill, Biden delivered remarks at the service in observance of Martin Luther King Jr. Day before he and first lady Jill Biden went to the International African American Museum, where he spoke and met people who attended an event in honor of King.

Biden chose to visit South Carolina because the state played a pivotal role in putting him in the White House during the 2020 election, following South Carolina Democratic Rep. Jim Clyburn’s endorsement, which helped breathe new life into his campaign.

In January 2024, Biden visited Mother Emmanuel AME, the site of a violent massacre by white supremacist Dylann Roof in 2015, and acknowledged that it was the hard work of the Black community nationally and in South Carolina that won him the presidency.

Like much of the latter half of his presidency, criticism of his handling of the ongoing genocide in Palestine lingered over that appearance, and his speech was interrupted by pro-Palestine protestors.

According to WCSC, Biden recalled his appearance at the Royal Missionary Baptist Church during his 2020 campaign.

“I prayed with you here in February of 2020 when I was running for president,” Biden told the crowd. “My final full day as president, of all the places I wanted to be, was back here with you.”

He also thanked the crowd, presumably a stand-in for South Carolina’s Black community at large, saying, “I owe you big. You’re the guys that brought me to the dance. Thank you. Thank you. Thank you. Thank you.”

Biden also told the congregation that whenever he spends time in a Black church, he thinks about “hope,” tying his remarks to the crucifixion of Christ, who in the Black Baptist tradition arose on a Sunday morning.

“We know the soul of this nation is difficult and ongoing,” Biden said. “But faith teaches us the America of our dreams is always closer than we think. That is the faith we must hold onto for the Saturdays to come. We must hold the hope. We must stay engaged. We must always keep the faith in a better day to come.”

Rep. Clyburn, a key Biden surrogate, introduced President Biden and remarked that although Biden is underappreciated (his approval rating in January is 40%), history will be kind to him.

“So I want to say to you, good friend, very little appreciation has been shown recently but feint [sic] not. History will be very proud of you,” Rep. Clyburn said.

He also echoed this sentiment ahead of Biden’s appearance, telling WCSC, “On substance, there’s no president since Lyndon Johnson that’s produced what Joe Biden has. Stylistically, he doesn’t fit the time within which we live. He’s not the soundbite guy. He is much more the substance guy.”

RELATED CONTENT: International African-American Museum Celebrates One-Year Anniversary