June 25, 2024

Once Upon A Time, Enslaved Africans Were An Insurance Commodity

Slave insurance was one of America’s earliest forms of industrial risk management that provided an important source of revenue for companies

By Dr. Stacey Patton

On the morning of April 20, 1859, a terrible explosion rocked the Bright Hope Coal Pits in Chesterfield County, Virginia, about 18 miles from the Richmond Railroad.

The tragedy claimed the lives of nine men, four of whom were white. Their names were solemnly printed in local newspapers across the South: Isaac Farmer, George Smith, Nicholas Blankenship, and Albert Rowe.

A dispatch from the Kanawha Valley Star reported: “The explosion created great excitement, and every effort was made to descend the shaft and to rescue the unfortunate men, dead or alive, but it was impossible to do so, because of the life destroying gasses, which seemed to fill the entire shaft.” The bodies were believed to have been entirely consumed in the explosion.

Among the victims were also five Black males whose names did not make it to the public record.

Press accounts identified those Black victims as “servants.” But they were slaves owned by four different white masters, male and female, and their deaths were noted only in terms of property loss. Archival records reveal that all five slaves had an insurance policy taken out on them, valued at $800 each, roughly equivalent to around $29,000 in today’s dollars. Payouts from the insurance policies likely went entirely to the purchaser of the plans, the slaveholders, leaving the loved ones of those victims still enslaved and penniless.

This incident sheds light on a grim chapter in American history, during which human lives were commodified and insured as property by some of the largest insurance companies in the world.

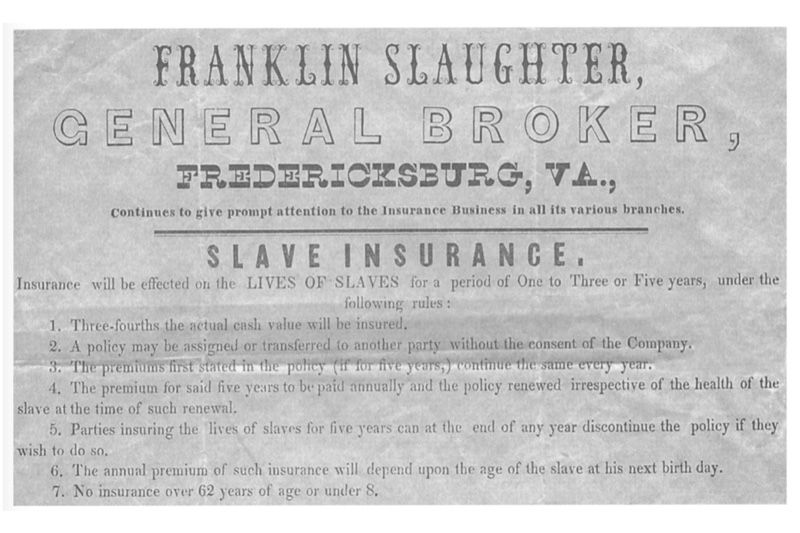

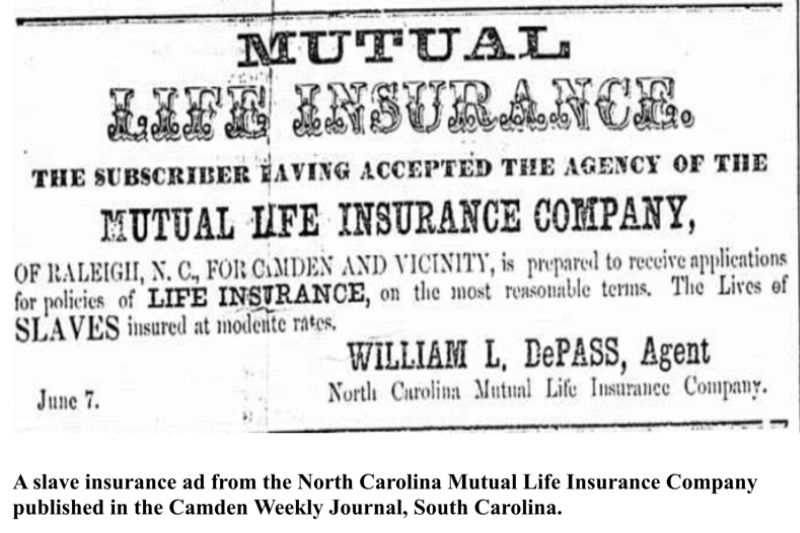

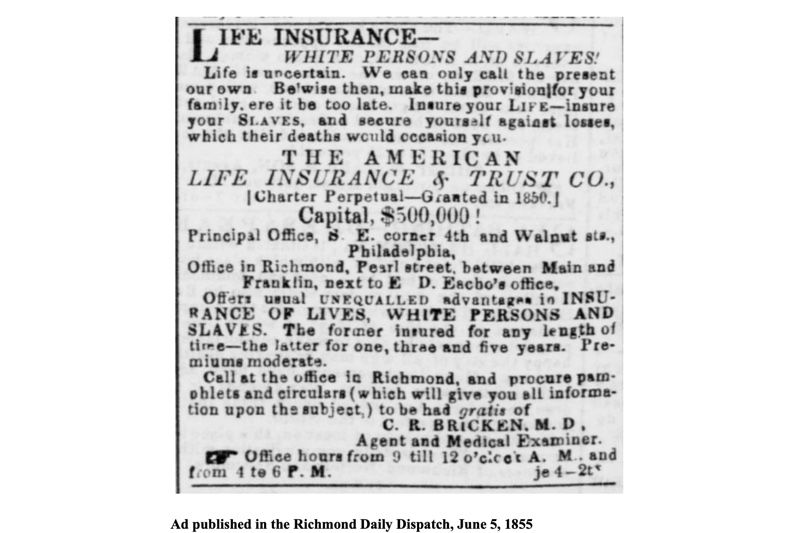

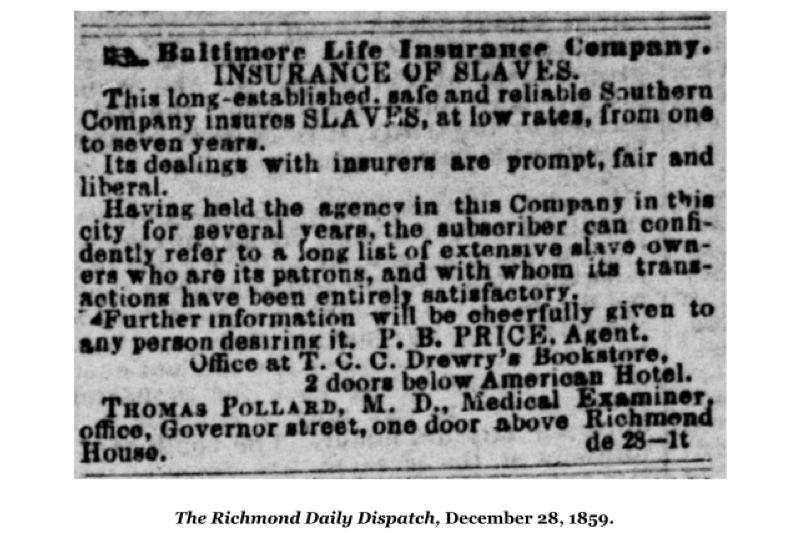

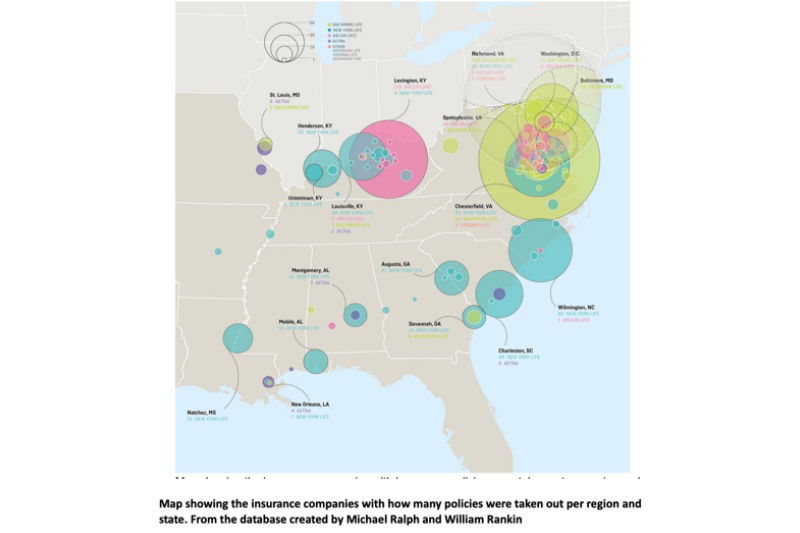

Several historians have noted that slave insurance was one of America’s earliest forms of industrial risk management that provided an important source of revenue for companies that included Baltimore Life, New York Life, AIG, Aetna, American Life, Virginia Life, Richmond Fire Association, North Carolina Mutual Life Insurance Company, Asheville Mutual Insurance Company, Lynchburg Hose and Fire Insurance Company, Greensborough Mutual Life, and others. It is important to note that Aetna Life first issued policies in 1853 out of Hartford, Connecticut, even though slavery had been illegal in the state since 1848.

Slave policies were not just about mitigating financial loss for white owners; they reveal a systemic dehumanization where the value of a human being was reduced to a mere monetary figure. Understanding the history of insurance companies and their role in perpetuating slavery can help us see the pervasive nature of racial dehumanization and its deep-seated roots in America’s financial systems.

Two years before the Bright Hope explosion, in February 1857, the hiring agency Tompkins & Company insured 14 slaves – ages 12 through 50 – to work in the nearby Black Health Coal Pits for one year. In January 1855, Richmond merchant Joseph Winston insured his slave Andrew, age 11, for $400 to work in a cotton factory across the river in Manchester. The policy term was for seven years, but Andrew died before the policy expired. Flash back even further to September 1843. Daniel Zacharias of Frederick, Maryland, insured his 27-year-old slave Robert Randall, a brickmaker, for $200. He, too, died near the end of the seven-year policy.

The coincidence of both an enslaved boy and a man dying before the expiration of their insurance policies raises troubling questions about the conditions they endured and the broader implications of insuring enslaved people. Their premature deaths, along with the Bright Hope victims, suggest a common thread of harsh and hazardous conditions that enslaved people faced daily. The backbreaking labor, whether in a cotton factory, coal pit, or as a brickmaker, the lack of medical care, and the overall brutal treatment inherent in slavery likely contributed to shortened lives.

While the exact circumstances of the 11-year-old boy and 27-year-old man remain unknown, this pattern of premature death invites speculation that the very act of insuring these Black lives might have inadvertently incentivized their owners to push them beyond their limits, knowing there was financial compensation in case of their demise. For enslaved men who would otherwise be considered unskilled, by the time they were in their mid to late 20s, were valued anywhere from $700 to $1,000 on average, according to appraisal values. This sum would be comparable to contemporary funds needed to purchase a starter car or put a down payment on a basic home, a range from $23,000 to $36,000.

The deaths of those Virginia and Maryland victims were more than just footnotes in history; they underscore the intersection between human suffering and financial exploitation. Enslaved people were considered liquid capital, able to be traded, sold, and rented as their enslavers saw fit.

Not only could they generate income through their labor, but their existence caused them to appreciate in their value until their mid-30s. Enslaved individuals considered skilled, whether as craftsmen, boatmen, or sawmill workers, could be valued at up to three times the price of the average field hand. This increase was due to the time and funds spent training individuals to be proficient in their assigned skills. Because of the high appraisal value, owners had more incentive to protect their human investment, leading to their utilization of insurance policies.

Historians tell us that life insurance did not become popular in the U.S. until the late antebellum period, from the 1830s until the start of the Civil War. People rarely had their lives insured and did not buy policies to cover the everyday risks on their lives or to protect the surviving spouses and children in case of the loss of the main breadwinner.

According to Todd Savitt, a leading scholar on slave life insurance, the first companies to offer the sale of life insurance policies included the Insurance Company of North America (1794), the Pennsylvania Company (1809), Massachusetts Hospital Insurance Company (1818), the New York Insurance Trust Company (1830), and Girard Life Insurance and Trust Company (1836). More than a dozen insurance companies were founded in the southern and border states between 1840 and 1860.

Prior to the mid-19th century, insurance companies had issued policies mostly confined to merchants who were transporting their captive human cargo. Due to the treacherous nature of the Middle Passage journey, there was a high chance for the loss of life, which translated into a loss of profit for slave ship owners. Once the trans-Atlantic slave trade was made illegal through an act of Congress in 1808, insurance companies turned their focus to enslaved populations already in the U.S. as appraisal values of Black lives began to rise.

Savitt notes that whites were increasingly insuring the lives of their slaves, but not in overwhelming numbers due to high costs. Though agents frequently advertised in local papers, owners were reluctant to shell out an extra $5 to $15 annually for each slave. Not to mention, there was confusion among owners between slaves as people and slaves as property. Horses, barns, and crops were often insured. So, what did this mean for an enslaved individual? When owners hired out a slave or rented one for a dangerous industrial job, the slave was obviously a piece of property, and the investment required financial protection.

According to Sharon Ann Murphy’s article, “Securing Human Property: Slavery, Life Insurance, and Industrialization in the Upper South,” the development of insurance policies for enslaved people emerged and grew significantly in the decades leading up to the Civil War. She explains that between the American Revolution and the Civil War, slavery in the U.S. underwent dramatic change. Initially concentrated in the production of tobacco, rice, and indigo along the southeastern coasts of Virginia and the Carolinas, slavery began to shift geographically and economically, with the rise of cotton as a dominant staple.

The invention of the cotton gin in 1793 and increasing demand from the British textile industry made large-scale cotton production highly profitable. This economic boom led to new settlements in the Lower South states, including South Carolina, Georgia, Alabama, Mississippi, Louisiana, and eastern Texas. As cotton prices surged, so did the demand for enslaved labor, driving up the prices of enslaved people.

Faced with declining tobacco profits and increasing labor costs, Upper South slaveholders sought new ways to profit from their enslaved populations. In the 1840s, with new industries opening en masse – steamboat operations, public works construction, iron manufacturing, railroads, coal mines, and cotton mills – enslaved people’s labor was redirected to these dangerous ventures. According to Murphy’s research, slaveholders also engaged in a vibrant internal slave trade, which saw over 700,000 slaves sold to the Lower South between 1790 and 1860. Owners rented or leased their slaves’ labor to companies and collected the income without having to supply food, housing, and clothing. Rental policies were often year-to-year, and so too were insurance policies. Murphy notes that these economic shifts paralleled the emergence of a life insurance industry in the northeastern U.S., which also saw an opportunity to insure enslaved people as property.

At inception, life insurance was mainly a northern-based industry. While Savitt’s research found that only about three percent of all industrial slaves and a substantially smaller number of plantation slaves in any year in the 1850s were covered by insurance, Murphy contends that by the eve of the Civil War, demand for slave insurance grew rapidly in the South. This demand paralleled the growth in policies on northeastern whites, and slaveholders were at the forefront of those who embraced this new product.

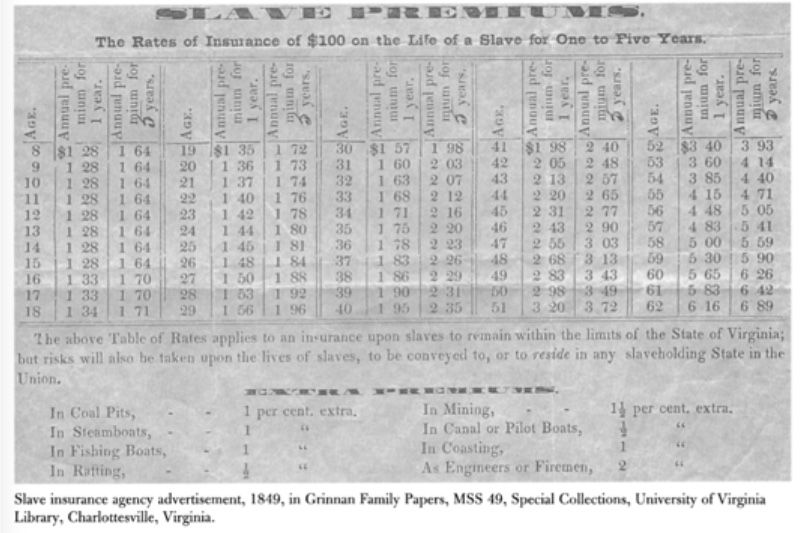

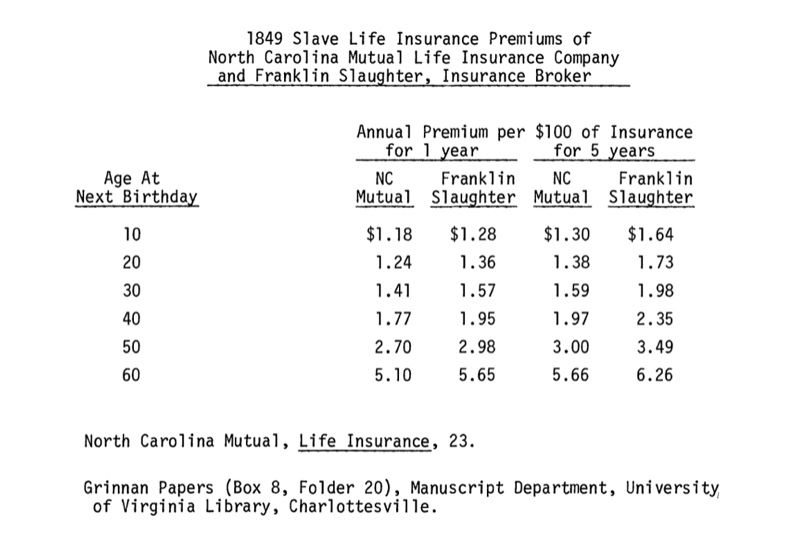

Companies limited the amount for which a slave could be insured, as well as the length of policy terms – four to five years for slaves ages 10 to 60 years old, while whites could purchase policies for life at a set annual premium. Slaves were not insured for their full value. To protect themselves from paying out more than necessary, companies refused to issue policies worth more than $800 or two-thirds or three-quarters of the appraised value of an enslaved person. The North Carolina Mutual Company included a stipulation that said, “in case the said slave shall die for want of proper medical or personal attendance … this Policy shall be void.”

Insurance companies also prohibited the free movement of insured slaves from region to region and charged extra premiums for dangerous jobs while requiring reputable medical doctors to examine individuals prior to policy approvals. Those doctors also received fees for their services, ranging from 15 cents to two dollars per exam. Enslaved individuals could be denied coverage for having chronic diseases, being of unsound mind, or for pregnancy.

If we examine insurance premium tables from the era, it is evident that starting at about age 32 for whites, premiums increased by five cents per plan year-to-year. By the 40s, the premiums were for a full dollar more than those for insuring an enslaved person even a decade younger. Most insurance companies preferred to insure enslaved people in the prime of their health, typically during late adolescence to young adulthood. Slaveholders, when considering the extra expense of purchasing insurance, would most likely insure men over women. Women were not only susceptible to higher mortality rates due to childbirth, but many enslavers also viewed them as more easily replaceable because their value was often tied to their reproductive capacity, as Daina Ramey Berry’s book The Price for their Pound of Flesh shows.

Due to the high expense of insurance policies, the average slaveholder could not afford to insure their bondsmen. Typically, there would be either one enslaved person under a policy for one owner or roughly ten policies under one owner. A.P. Scott of Fayette, Kentucky, had 18 policies on enslaved men at some point in the 1850s. His neighbors had their enslaved people insured for jobs such as firemen and boat navigators. Most insured were men, with their policies listed in Alabama, Arkansas, the District of Columbia, Georgia, Kentucky, Missouri, Mississippi, the Carolinas, and Virginia.

Despite the large number of enslaved people held hostage in the United States, comparatively few insurance policies were taken out on them. Over roughly two decades, from the 1840s to the early 1860s, only about 1,000 policies were issued by larger, cross-state companies. While smaller companies, many of which have since gone defunct, issued more policies than have been formally recorded, even assuming those companies together comprised another 1,000 policies, this would still represent a fraction of a percent of all the enslaved people who existed during that time. In 1860 alone, there were almost 4 million enslaved people in the United States. At any one point in time, there would likely have been only a few hundred policies on enslaved people per year. Several million dollars were historically stored in life insurance policies. Policies on enslaved laborers tended to have higher premiums, as many companies went bankrupt due to heavy losses and insurance claims related to deaths from disease.

The Civil War and Emancipation had a profound impact on insurance companies that had issued policies on enslaved people.

With the abolition of slavery following the Civil War, the property that these policies insured – enslaved individuals – no longer existed in legal terms. This effectively rendered all such policies null and void, as the insured “property” had been emancipated. Insurance companies that had issued these policies faced significant financial losses. Many policies were long-term, and the companies had collected premiums with the expectation of providing coverage over the entire term.

The sudden end to slavery meant that these companies could no longer collect premiums or fulfill their obligations under the policies, leading to potential disputes and financial instability. The end of slavery forced insurance companies to reassess their business models and reputations. This likely involved diversifying their policy offerings and focusing on other areas of life and property insurance.

What if slavery had continued beyond the Civil War?

Insurance companies would likely have seen an expansion in the market for slave policies. As the institution of slavery grew or remained stable, more slaveholders might have sought to insure their enslaved people to protect their investments, leading to a larger, more lucrative market for these insurance products. With continued demand for slave insurance, companies might have developed more specialized and varied insurance products tailored to different types of enslaved labor, such as field hands, skilled laborers, and domestic servants. Innovations could have included policies covering not only death but also injury, escape, and loss of productivity.

In the aftermath of slavery, insurance companies charged Black people higher rates for life insurance than whites. Their premiums were based on racist theories about Black bodies, health, longevity, and social habits. Meanwhile, Black mutual aid societies, which had been established during the antebellum period, continued to support Black communities as an early form of insurance to ensure proper burials and support for surviving loved ones.

Scholars have noted that at least 1,300 antebellum-era policies have been found in the archives of the world’s largest insurance companies, and evidence suggests that at least 85% of policy records have been lost. So, what does this mean for our understanding of the full scope of insurance companies’ involvement in perpetuating slavery?

This significant loss of records means that the full extent of insurance companies’ involvement in slavery is likely much greater than what current evidence shows. The surviving records are only a fraction of the total number of policies that were likely issued. This incomplete historical record suggests that many more enslaved individuals were insured, and insurance companies played a more extensive role in the economic mechanisms that sustained and profited from slavery.

Since 2004, several states have required the disclosure of their ties to slavery, producing documents from their archives and former records. Beyond being tasked with making their archives and records public, there does not appear to have been much further action taken to provide reparations to those whose ancestors were formerly enslaved.

RELATED CONTENT: